Understanding Restricted Stock Units (RSUs) for Home Loans: What You Need to Know

When it comes to qualifying for a mortgage, many homeowners are surprised by the complexities of using their Restricted Stock ...

Navigating the New Landscape: What the Recent NAR Settlement Means for Homebuyers and Sellers

The real estate market is undergoing a significant transformation due to a recent settlement involving the National Association of Realtors ...

Understanding the Impact of Mortgage Rate Lock-In on Home Sales

Have you ever wondered why so many homes seem to be staying off the market lately? It's not just a ...

Leveraging Home Equity in Retirement: The Advantage of HECMs Over HELOCs

For seniors aged 62 and over, managing cash flow in retirement can be challenging. While Home Equity Lines of Credit ...

2024 Housing Forecast: Key Insights you need, Homebuyers and Realtors

I'd like to share my insights and forecast for the housing market in 2024, drawing from the valuable analysis of ...

Imagine Become a 1st Time Homebuyer and Investor in One Swoop

Imagine owning a multi-family home, living in one unit, and having the other units pay your mortgage. Sounds like a ...

ESTATE PLANNING: 7 Reasons to Put Your Home in a Trust

A property trust is a legal entity set up to pass down assets to beneficiaries after a grantor’s passing. In ...

Overcoming the Down Payment Barrier: A Guide for First-Time Homebuyers

As a loan officer, I see one of the common barriers faced by first-time homebuyers is the misconception surrounding down ...

Mortgage Brokers: The Better Option for Homebuyers

When it comes to purchasing a home, there are crucial decisions to be made, and one of the most significant ...

5 Reasons Why Good Credit is So Important

When it comes to financial goals, building good credit might not be the first thing on your mind. But let ...

Mortgage Market News

Uncertainty surrounding the debt ceiling caused volatility in the markets, while inflation was hotter than expected in April. Tight supply ...

Property Tax and Understanding Prop 19 Rules in California: What Property Owners Need to Know

Proposition 19, or Prop 19 for short, is a new law that has been introduced in California. It has been ...

Mello-Roos. What is it and what should I know about it as a homebuyer?

Mello-Roos is a special tax that is used to fund infrastructure and services in new developments in California. When a ...

How to Cancel Mortgage Insurance

As a homeowner, one of the biggest expenses you might have to deal with is mortgage insurance. Mortgage insurance is ...

7 Compelling Benefits of Homeownership for First-Time Buyers

Purchasing a home is a big decision, and as a first-time homebuyer, you may be wondering whether it's the right ...

VA Home Loans in San Diego County: A Comprehensive Guide

If you're a veteran or active-duty military member looking to purchase a home in San Diego County, you may want ...

House Hacking: What is it? Is it for me?

House hacking is a strategy for investing in real estate that involves generating income from your home, while you live ...

Non-Qualified Mortgages: The Good, The Bad and The Ugly

What is a non-qualified mortgage (non-QM)? This is a home loan that is not required to meet agency standard documentation ...

Top 10 Questions to Ask Your Lender

Working with a lender, when done right, is the beginning of a life long relationship. Your personal story has to ...

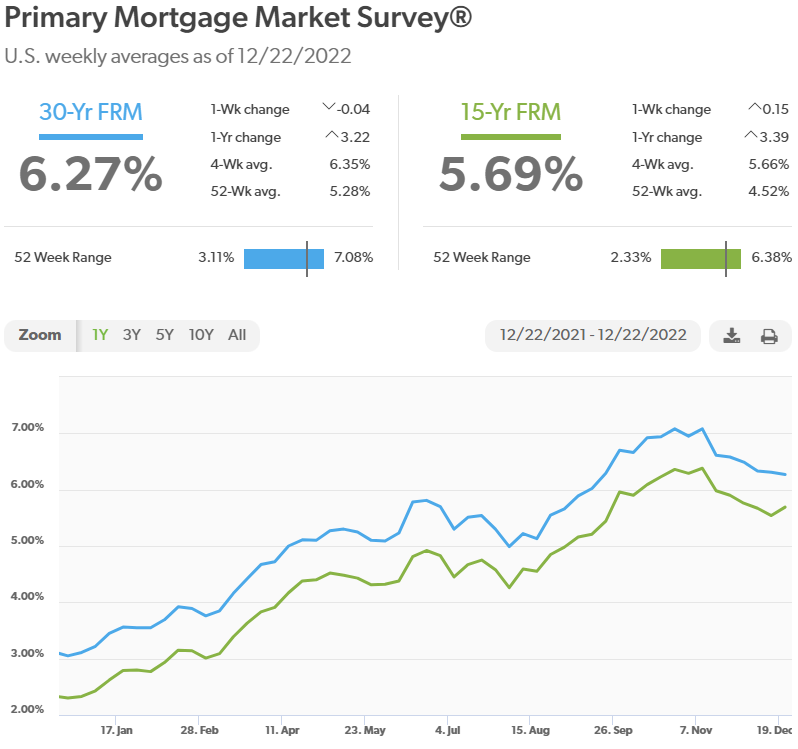

Mortgage Rates Continue to Drift Down

Mortgage Rates continue to come down as we head into the last week of 2022. This trend will begin to ...

Assumable Mortgages: What to Know

What is an assumable mortgage? An assumable mortgage is a type of financing arrangement whereby an outstanding mortgage and its terms ...

My credit identity has just been stolen…What to do: NOW!

Don’t Panic: Unfortunately, this is too common of a practice. Your have rights, protection and you can regain your credit ...

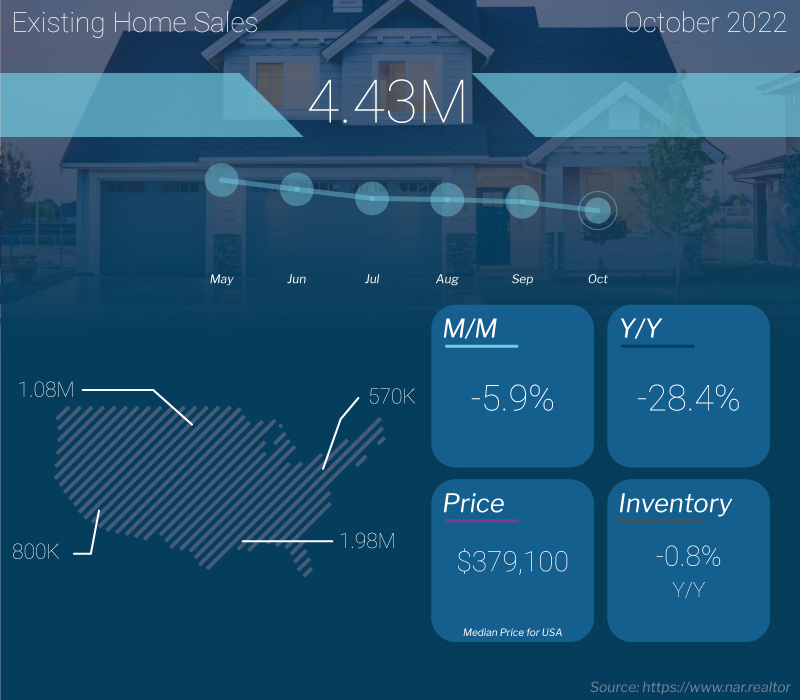

There is an Opportunity Brewing in the Housing Market

Last year, the real estate market was so hot that many buyers had to pay over asking price and struggled ...

The Fed’s strategy: the basics

Wait… doesn’t raising rates mean higher prices, and worse inflation? Let me explain. In the most basic sense, inflation is ...

What is the Fed doing?

One of the questions that I have been continually asked most recently, has been, “doesn’t raising rates mean higher prices, ...

Truth About Rates

Advertised rates vs. what you may receive. Rates are based on credit, loan to value, property type, market conditions and ...